Finance and Accounting

What does an accountant do?

In this module you learned some of the basics about accounting but the accounting profession is actually extremely varied. An accountant can work in any industry, for any type of business, small or large, for profit or nonprofit, and accountants also work for individuals. Here are some examples of different types of jobs that you could do if you had an accounting background.

Nonprofit Accountant[1]

Nonprofit accountants work within nonprofit organizations, such as charities or educational institutions. They handle accounting and financial management specific to nonprofit entities, including grant management, fundraising compliance, and financial reporting. One key distinction for a nonprofit accountant is a focus on tracking how the organization uses their funds. For example, if a someone makes a donation to an education nonprofit with the condition that it must be spent on teacher training, the accountant must track those restricted funds and keep the organizational accountable for using it in the specified way. Working as a nonprofit accountant is a good choice if you are interested in working within an organization with a mission that resonates with you.

Auditor[2]

Auditors examine financial records, statements, and documentation to ensure accuracy and compliance with laws and regulations. They may work for accounting firms or within organizations to assess financial controls and identify potential risks. Auditors often must explain their findings which includes written reports and meetings with managers and clients. An external auditor works for an outside organization and not the one they are auditing, while an internal auditor is employed by the organization they are auditing.

Tax Accountant[3]

Tax accountants specialize in tax planning, preparation, and compliance for individuals, businesses, or organizations. They stay updated on tax laws and regulations to minimize tax liabilities and ensure compliance with tax obligations. Tax accountants are often Certified Public Accountants (CPAs). Some tax accountants who do not hold the CPA credential are enrolled agents who have passed the Internal Revenue Service’s (IRS) Special Enrollment Exam and are able to represent clients in tax matters being disputed before the IRS.

Financial Analyst[4]

Financial analysts analyze financial data to provide insights and recommendations for investment decisions. They assess company performance, industry trends, and economic factors to guide financial planning and investment strategies. Because investing has become more global, and some business specialize in investments in a particular country or world region, financial analysts may also specialize so that they understand the business environment, culture, language, and political conditions in the country or region that they cover. Financial analysts may work within businesses, for individuals, for media outlets reporting on business matters, or for organizations that do financial research.

Management Accountant[5]

Management accountants, also known as cost, corporate, industrial, managerial, or private accountants, focus on analyzing accounting and financial information for internal decision-making. They assist management by creating budgets, analyzing costs, and evaluating the financial impact of business decisions. The information that management accountants prepare is intended for internal use by managers, not for the public. Management accountants may help organizations plan the cost of doing business. Some work with financial managers on asset management, which involves planning and selecting financial investments such as stocks, bonds, and real estate.

Forensic Accountant[6]

Forensic accountants investigate financial fraud, embezzlement, and other financial crimes. They use their accounting skills to analyze and track financial data and assist in legal proceedings. Forensic accountants may examine records in bankruptcies and contract disputes. Many forensic accountants work closely with law enforcement and lawyers during investigations and may appear as expert witnesses during trials.

Government Accountant[7]

Government accountants work in various government agencies at local, state, or federal levels. They handle financial management, budgeting, and auditing for government entities, ensuring compliance with relevant laws and regulations. Their responsibilities include making sure that revenues are received and spent according to relevant laws and regulations.

Financial Controller[8]

A financial controller is a kind of financial manager who oversee an organization’s accounting and finance functions. They direct the preparation of financial reports that summarize and forecast an organization’s financial position. These reports may include income statements, balance sheets, and analyses of future earnings or expenses. Often, controllers oversee the accounting, audit, and budget departments of their organization. They play a crucial role in financial decision-making and strategic planning.

How can I learn more about accounting?

Operations and Supply Chain

- Create a digraph for the following set of tasks:

[latex]\begin{array}{|l|l|l|} \hline \text { Task } & \text { Time required } & \begin{array}{l} \text { Tasks that must be } \\ \text { completed first } \end{array} \\ \hline \mathrm{A} & 3 & \\ \hline \mathrm{B} & 4 & \\ \hline \mathrm{C} & 7 & \\ \hline \mathrm{D} & 6 & \mathrm{A}, \mathrm{B} \\ \hline \mathrm{E} & 5 & \mathrm{B} \\ \hline \mathrm{F} & 5 & \mathrm{D}, \mathrm{E} \\ \hline \mathrm{G} & 4 & \mathrm{E} \\ \hline \end{array}[/latex]

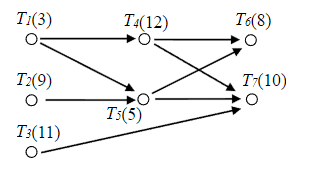

- Using the priority list [latex]\mathrm{T}_{4}, \mathrm{T}_{1}, \mathrm{T}_{7}, \mathrm{T}_{3}, \mathrm{T}_{6}, \mathrm{T}_{2}, \mathrm{T}_{5}[/latex], schedule the project with two processors. Use the digraph below:

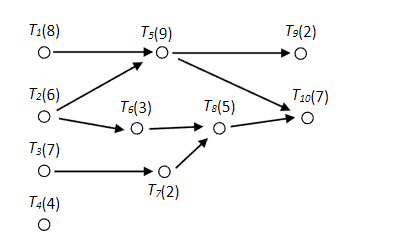

Use this digraph for the next 3 problems.

- Using the priority list [latex]\mathrm{T}_{4}, \mathrm{T}_{3}, \mathrm{T}_{9}, \mathrm{T}_{10}, \mathrm{T}_{8}, \mathrm{T}_{5}, \mathrm{T}_{6}, \mathrm{T}_{1}, \mathrm{T}_{7}, \mathrm{T}_{2}[/latex] schedule the project with two processors.

- Using the priority list [latex]\mathrm{T}_{4}, \mathrm{T}_{3}, \mathrm{T}_{9}, \mathrm{T}_{10}, \mathrm{T}_{8}, \mathrm{T}_{5}, \mathrm{T}_{6}, \mathrm{T}_{1}, \mathrm{T}_{7}, \mathrm{T}_{2}[/latex] schedule the project with three processors.

-

- Apply the backflow algorithm to find the critical time for each task

- Find the critical path for the project and the minimum completion time

- Use the critical path algorithm to create a priority list and schedule on two processors.

- Use the critical path algorithm to schedule the problem from #1 on two processors.

- Indeed. “Nonprofit Accounting: What It Is and How To Perform It (With Best Practices),” June 24, 2022. https://www.indeed.com/career-advice/career-development/nonprofit-accounting . ↵

- U.S. Bureau of Labor Statistics. “Accountants and Auditors,” September 8, 2022. https://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm#tab-2. ↵

- TurboTax. “What Is a Tax Accountant?,” February 23, 2023. https://turbotax.intuit.com/tax-tips/tax-pro/what-is-a-tax-accountant/L0U5KAIj2 . ↵

- U.S. Bureau of Labor Statistics. “Financial Analysts,” February 6, 2023. https://www.bls.gov/ooh/business-and-financial/financial-analysts.htm#tab-2. ↵

- “Accountants and Auditors.” ↵

- Id. ↵

- Id. ↵

- U.S. Bureau of Labor Statistics. “Financial Managers,” September 8, 2022. https://www.bls.gov/ooh/management/financial-managers.htm#tab-2. ↵